17/07/2024

17/07/2024

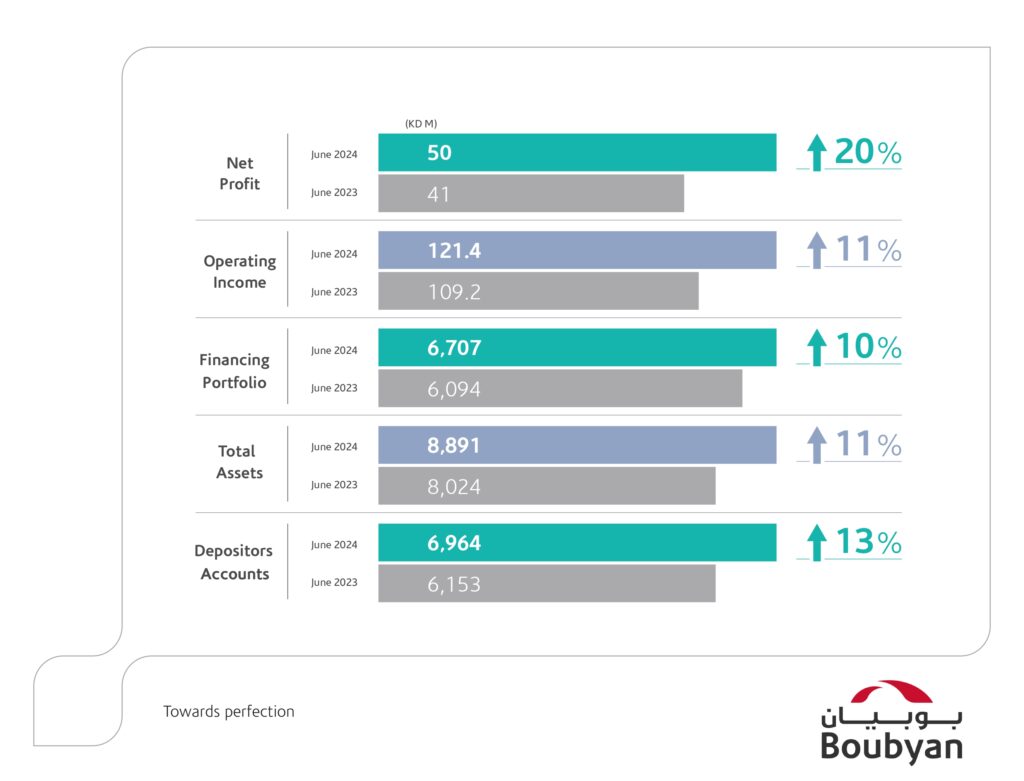

Kuwait City, July 17: Boubyan Bank has announced KD 61 million in operating profits for the first half of this year as the bank recorded KD 50 million in net profits at a growth rate of 20% compared with last year, while the earnings per share amount to 11.1 fils.

Mr. Adel Al-Majed, Boubyan Bank’s Vice-Chairman & Group Chief Executive Officer, commented on the financial results: “All financial indicators of Boubyan during H1, 2024 highlight the strength and robustness of our profitability, assets, liquidity ratios, and operational performance, which led to maintaining a solid financial foundation, coupled with a flexible business model that gives room for growth and for aligning with the requirements of business sectors.”

Al-Majed highlighted the most significant financial indicators during H1, where the bank’s assets grew to KD 8.9 billion at a growth rate of 11% compared with last year, while the bank’s financing portfolio grew by 10% to reach KD 6.7 billion, and operating income grew by 11% to KD 121.4 million, whereas the bank’s market share of local financing increased to 11.7%.

He added: “Results of this period are attributed to our strategy of focusing on new markets with promising growth opportunities and positive financing investments with profitability for the bank’s investing customers and its shareholders. This is added to focusing on digital innovation and growth of the bank’s operational performance, efficient liquidity, and the bank’s good reputation, along with the great improvement of our state-of-the-art banking solutions and excelling in innovative offerings that meet the needs of various customer segments.”

** Group Wealth Management

“With ‘Boubyan 2028’ strategy, we have activated our group-wide investment management plan to expand our investment solutions and opportunities, and to discover new markets in order to accelerate the attraction of more wealth and manage the same in order to offer the best to our customers with an investment appetite. The 2028 strategy is well-aligned with the bank’s mission and its ESG focus.”, Al-Majed added.

Al-Majed went on to add: “Boubyan's wealth management is not merely about offering investment advice; rather, it is a holistic process and approach that integrates strategic and investment partnerships that ensure full understanding of the investor’s financial position as well as the most significant goals, proper planning and management of risks in order to safeguard and grow the wealth.”

** Subsidiaries

Boubyan Group’s subsidiaries continued making significant achievements by diversifying and improving their offerings, and targeting all companies in various sectors in order to offer innovative and cutting-edge banking services, while Boubyan continued pursuing its strategy that focuses on local and international expansion.

Furthermore, and as a part of its regional expansion, a subsidiary of BLME was established in the Kingdom of Saudi Arabia, in addition to BLME’s headquarters in London and Dubai, in order to increase its customer base and to offer innovative investment solutions. .

As an investment arm of Boubyan Group, Boubyan capital continued to strike a balance between long-term goals and short-term needs through offering a group of various financial solutions, and succeeded in increasing its managed assets and customer base, in addition to successfully launching 3 investment funds, thus placing Boubyan Local and GCC Equity Fund in the lead of top investment funds in Kuwait.

Moreover, Boubyan Capital launched its own digital roadmap due to be completed by the end of 2024 with the aim of digitalizing the processes and improving the investment customer experience in order to make Boubyan Capital’s App the cornerstone of the company’s digital and investment roadmap that enables them to manage and monitor their investments anywhere and at any time.

As for Boubyan Takaful Insurance Company, it continued its progress towards sustainable improvement and growth of its business to achieve quality service by innovating and introducing new competitive insurance solutions, and developing a complete group of insurance policies such as the launch of Boubyan Drive Auto Insurance Policy for the first time in Kuwait. The company completed its digital transformation process through Boubyan App, restructured its digital platform features, and updated its applications as per latest programming standards to cope with the digital plan recently introduced by the insurance control unit.

** Awards and International Ratings

During H1 of this year, the bank received two awards, namely the “Most Innovative Bank of the Year” and “Best Digital Banking Initiative” by MEED, the internationally renowned publication. This came as a part of its MENA Banking Excellence Awards 2024.

This new achievement highlights the success of the bank’s comprehensive program, which is aligned with business approaches and strategies to upgrade the infrastructure for digital transformation, and to boost the performance and the competitiveness, especially after launching several innovative solutions and services guided by an outstanding banking vision, which led to a leap in digital banking.

Furthermore, and in a testimony to its prestigious status in the financial and banking sector locally and internationally, Boubyan Bank has been included in Forbes’ annual list for Middle East Top 100 Listed Companies 2024. The bank ranked 64th regionally and 3rd among local banks on the same list, with a market value of $8 billion and $27.3 billion in total assets.

The bank was further ranked 3rd locally and 49th regionally in MEED’s List for the 100 Largest Listed Companies in MENA for 2024.

Furthermore, the bank’s ratings from Moody’s, Fitch, and S&P remain stable at “A2”, “A”, and “A” respectively. As for the ex-government support (or xgs) rating assigned by Fitch, it stood at “BBB”. The introduction of such new criteria communicates Fitch’s view of the creditworthiness of Boubyan excluding assumptions of extraordinary government support. Boubyan was assigned the second highest rating in Kuwait as per such criteria.

** Human Capital Development

Boubyan continued supporting its human resources and recruiting national cadres, and was able to reach the highest percentage of national manpower across the private sector, which now exceeds 81%, and continued its enablement approach for women, who now account for 30% of the bank’s employees, with many of them occupying leadership positions.

The bank’s human resources proved themselves to be one of the key pillars of the bank’s ongoing success, as they embrace and adopt Boubyan's future vision, which greatly contributes to the introduction of innovative and creative ideas and deliverables, while reiterating the bank’s commitment to providing all that is necessary to support our human resources’ leadership role in a real and sustained manner to have a positive effect on the future job market and achieve the desired results in terms of increasing our productivity and the profitability rates of the bank.

Highlights:

1st Highlight

Boubyan Bank’s CEO - Private, Consumer & Digital Banking, Mr. Abdullah Al-Tuwaijri attended the FinTech Summit in Dubai to speak about the recent transformations and developments in FinTech and the promising growth opportunities.

He further attended the Gulf Creatives Conference 2024, held at the prestigious Harvard Graduate School of Education to discuss the proactive vision and well-studied plans for investment in digital transformation at Boubyan.

2nd Highlight

Boubyan Bank released its 4th Sustainability Report for the year 2023, titled: “Integration into Corporate Strategy” to reflect the bank’s initiatives towards adopting proactive practices that effectively contribute to our sustainable ESG approach to build a more inclusive and sustainable future for everybody.

- Key Financial Indicators - KD Million

| Growth | First Half 2023 | First Half 2024 | Indicator |

| 20% | 41 | 50 | Net profits |

| 11% | 109.2 | 121.4 | Operating income |

| 13% | 6,153 | 6,964 | Customers’ deposits |

| 10% | 6,094 | 6,707 | Financing portfolio |

| 11% | 8,024 | 8,891 | Assets |