23/02/2025

23/02/2025

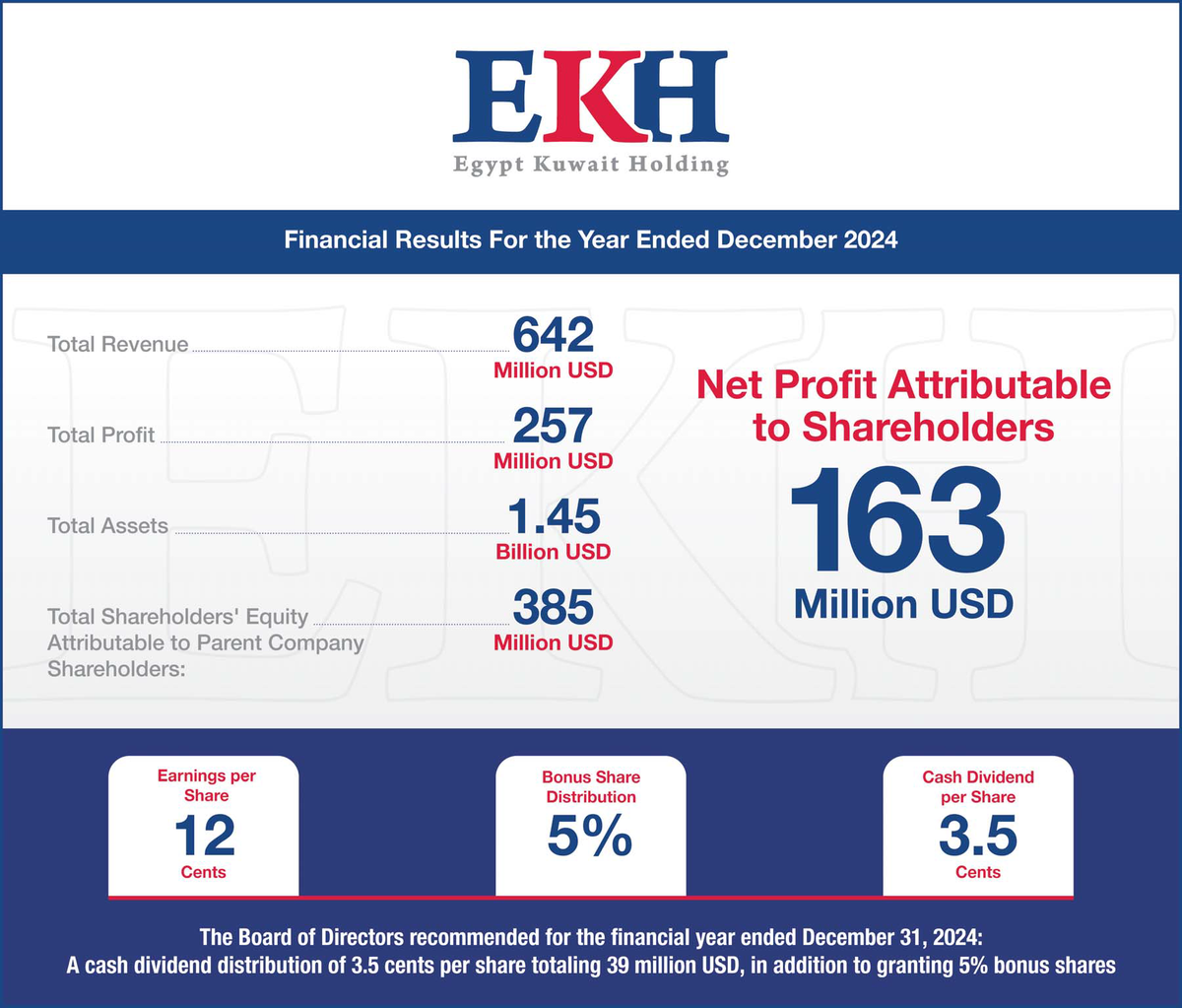

KUWAIT CITY, Feb 23: Today, Egypt Kuwait Holding Company (EKH) announced its consolidated financial results for the fiscal year ended 31 December 2024, prepared in accordance with Egyptian Accounting Standards. EKH reported total revenues of USD 642 million, supported by a gross profit margin of 40% and an EBITDA margin of 39%. The company recorded a net profit of USD 185 million, with a 2 percentage point expansion in net profit margin, reaching 29%. Meanwhile, net profit attributable to EKH shareholders stood at USD 163 million during the same period, the Board of Directors has recommended a cash dividend distribution of 3.5 cents per share and a 5% bonus share issuance. During 4Q 2024, EKH recorded revenues of USD 167 million, reflecting a 9% quarter-on-quarter growth, driven by strong revenue performance across the company’s various business segments, reflecting improving market conditions. The company successfully maintained profitability margins despite economic challenges, with gross profit and EBITDA margins reaching 41% and 42%, respectively during the period. Net profit for 4Q 2024 stood at USD 46 million, accompanied by a 5 percentage point expansion in net profit margin to 28%. Net profit grew by 20% quarter-on-quarter, while net profit attributable to EKH shareholders reached USD 39 million for the same period. Commenting on the Group’s Performance in 2024,Loay Jassim Al-Kharafi, Chairman of Egypt Kuwait Holding (EKH), expressed his satisfaction with the strong performance achieved by the Group in the fourth quarter of 2024, highlighting its ability to sustain robust profitability levels across all operational sectors. Al-Kharafi further emphasized that EKH successfully navigated operational and economic challenges throughout 2024, attributing this resilience to the Group’s well-defined strategy and flexible business model. These factors have enhanced EKH’s ability to achieve sustainable growth and drive long-term success.

The positive financial results reflect a notable recovery in prices and an increase in sales volumes of core products, reinforcing confidence in the strength and sustainability of the Group’s business portfolio and paving the way for ambitious expansion plans in 2025. Al-Kharafi affirmed that the Group’s top priorities include boosting foreign currency revenues, expanding exports, and strengthening its financial position while continuing to contribute to regional economic development. He also noted that EKH’s first investment in Saudi Arabia is expected to commence commercial operations in the coming months. Additionally, the Group is advancing its ambitious investment strategy, which includes its first strategic investment beyond the Middle East and North Africa region during the current year, expanding its global operational footprint. This reflects EKH’s commitment to managing foreign exchange risk, expanding into high-growth markets, and diversifying its investment portfolio across sectors and geographies. Al-Kharafireiterated that maximizing sustainable shareholder value remains a fundamental pillar of EKH’s strategy.

The Board of Directors has recommended a distribution of both cash and stock dividends, underscoring the Group’s efforts to strike a balance between rewarding shareholders and reinvesting for future growth. He concluded by affirming that 2025 will see the company continue optimizing capital allocation strategies and focusing on high-value projects that generate maximum returns for all stakeholders. Commenting on the Group’s Performance,Jon Rokk, Managing Director of Egypt Kuwait Holding (EKH), expressed his pride in the strong results delivered by the Group in 2024, despite the significant economic challenges that shaped the year. He emphasized that EKH successfully navigated these challenges and achieved strong growth rates, thanks to its resilient business model and adaptability to evolving market conditions.

Rokk highlighted that these achievements are a testament to the dedication and commitment of EKH’s entire team, as each individual’s contribution has strengthened the company’s ability to overcome obstacles, seize opportunities, and sustain growth. He further stated that EKH maintained its strong momentum in the fourth quarter of 2024, reflected in quarter-on-quarter revenue and net profit growth of 9% and 20%, respectively. He affirmed that EKH is entering a new phase of development that mirrors its ambitions and future growth plans while reinforcing its commitment to building a more dynamic and future-focused organization. Rokk also noted that the Group will continue to build upon these achievements, with future projects set to serve as a cornerstone for regional and international expansion. Additionally, these efforts will further enhance growth and drive investment diversification. He then reviewed the performance of EKH’s key subsidiaries in 2024, as follows:

The positive financial results reflect a notable recovery in prices and an increase in sales volumes of core products, reinforcing confidence in the strength and sustainability of the Group’s business portfolio and paving the way for ambitious expansion plans in 2025. Al-Kharafi affirmed that the Group’s top priorities include boosting foreign currency revenues, expanding exports, and strengthening its financial position while continuing to contribute to regional economic development. He also noted that EKH’s first investment in Saudi Arabia is expected to commence commercial operations in the coming months. Additionally, the Group is advancing its ambitious investment strategy, which includes its first strategic investment beyond the Middle East and North Africa region during the current year, expanding its global operational footprint. This reflects EKH’s commitment to managing foreign exchange risk, expanding into high-growth markets, and diversifying its investment portfolio across sectors and geographies. Al-Kharafireiterated that maximizing sustainable shareholder value remains a fundamental pillar of EKH’s strategy.

The Board of Directors has recommended a distribution of both cash and stock dividends, underscoring the Group’s efforts to strike a balance between rewarding shareholders and reinvesting for future growth. He concluded by affirming that 2025 will see the company continue optimizing capital allocation strategies and focusing on high-value projects that generate maximum returns for all stakeholders. Commenting on the Group’s Performance,Jon Rokk, Managing Director of Egypt Kuwait Holding (EKH), expressed his pride in the strong results delivered by the Group in 2024, despite the significant economic challenges that shaped the year. He emphasized that EKH successfully navigated these challenges and achieved strong growth rates, thanks to its resilient business model and adaptability to evolving market conditions.

Rokk highlighted that these achievements are a testament to the dedication and commitment of EKH’s entire team, as each individual’s contribution has strengthened the company’s ability to overcome obstacles, seize opportunities, and sustain growth. He further stated that EKH maintained its strong momentum in the fourth quarter of 2024, reflected in quarter-on-quarter revenue and net profit growth of 9% and 20%, respectively. He affirmed that EKH is entering a new phase of development that mirrors its ambitions and future growth plans while reinforcing its commitment to building a more dynamic and future-focused organization. Rokk also noted that the Group will continue to build upon these achievements, with future projects set to serve as a cornerstone for regional and international expansion. Additionally, these efforts will further enhance growth and drive investment diversification. He then reviewed the performance of EKH’s key subsidiaries in 2024, as follows:

Loay Jassim Al-Kharafi

Fertilizers | AlexFert AlexFert recorded revenues of USD 59 million in 4Q 2024, reflecting a 26% quarter-on-quarter growth, driven by the notable improvement in global urea prices and government efforts to ensure stable natural gas supplies for production operations. This stability enabled the company to operate its plants at full capacity starting December 2024. Additionally, gross profit and EBITDA margins expanded by 1 and 2 percentage points year-on-year, respectively, during the fourth quarter, reflecting the company’s ongoing cost-reduction initiatives and improved operational efficiency.Net profit stood at USD 29 million, with the net profit margin expanding by 5 percentage points to 49% year-on-year in 4Q 2024. For FY 2024, AlexFert reported total revenues of USD 213 million, supported by the availability of natural gas supplies. The company maintained strong profitability, with gross profit and EBITDA margins reaching 36% and 44%, respectively, alongside a 2 percentage point year-on-year expansion in net profit margin. Looking ahead, the company expects to sustain its strong performance, benefiting from stable natural gas supplies supported by government measures and the continued recovery in global urea prices. Urea prices increased by 8% quarter-on-quarter in 4Q 2024 to reach USD 364 per ton, while the average global urea price stood at USD 387 per ton in January 2025.

Jon Rokk

Oil & Gas | North Sinai Concession The North Sinai Offshore Concession recorded revenues of USD 19 million in 4Q 2024, reflecting a 32% year-on-year increase and 25% quarter-on-quarter growth. This strong performance was driven by the successful commissioning of new wells, leading to increased production volumes.Net profit for the quarter stood at USD 9 million, with a net profit margin of 47%, marking a 6 percentage point expansion year-on-year. For FY 2024, the North Sinai Offshore Concession reported total revenues of USD 62 million, reflecting a 7% year-on-year increase. Meanwhile, net profit amounted to USD 31 million, with a net profit margin of 50%. The company continues to deliver strong operational results, supported by its expansion initiatives. The commencement of production at the Aton-1 and KSE2 wells is expected to sustain stable gas production levels at approximately 55 million cubic feet per day (MMSCFD) until the end of 2026. Additionally, the North Sinai Offshore Concession will benefit from the recent 10-year extension of its Concession Agreement, approved by the Egyptian General Petroleum Corporation (EGPC) during the year, further enhancing the long-term sustainability of its operations.

Petrochemicals | Sprea Misr Sprea Misr reported revenues of EGP 1.54 billion in 4Q 2024, reflecting a 50% year-on-year increase and 16% quarter-on-quarter growth. This strong performance was driven by higher sales volumes and an increase in the average prices of key products.Gross profit margin remained stable at 32%, while EBITDA margin expanded to 31%. Net profit surged 92% year-on-year to EGP 546 million in 4Q 2024, with net profit margin expanding by 8 percentage points year-on-year to 36%. For FY 2024, Sprea Misr recorded total revenues of EGP 5.84 billion, marking a 19% year-on-year growth. Meanwhile, net profit stood at EGP 2.64 billion, with a 2 percentage point expansion in net profit margin to 45%, supported by foreign exchange gains and higher interest income. Looking ahead, the company aims to maximize benefits from the gradual price recovery, alongside the growing demand for Sulfonated Naphthalene Formaldehyde (SNF). Additionally, the anticipated acceleration of construction and infrastructure projects in Egypt is expected to further support growth.

Utilities & Energy-Related Activities | NatEnergy NatEnergy reported revenues of EGP 1.6 billion in 4Q 2024, reflecting a 46% year-on-year increase. This growth was driven by the strong performance of Kahraba, the Group’s electricity distribution subsidiary, as well as progress made by Fayum Gas on one of its ongoing infrastructure projects.During the fourth quarter, gross profit and EBITDA margins expanded by 6 percentage points quarter-on-quarter, reaching 30%, while net profit increased 49% year-on-year to EGP 505 million. For FY 2024, NatEnergy recorded total revenues of EGP 5.3 billion, marking a 30% year-on-year increase, while net profit grew 21% to EGP 1.8 billion. Looking ahead, the company aims to capitalize on the recent electricity tariff increases and continue focusing on attracting high-margin customers to enhance overall profitability. Additionally, Kahraba is expanding its investment strategy with the construction of a new power substation in the 10th of Ramadan area, aimed at meeting the rising electricity demand in the industrial zone.

Non-Banking Financial Services & Other Diversified Sectors The diversified segment recorded total revenues of USD 25 million in 4Q 2024, with gross profit margin reaching 59%, marking a 6 percentage point increase year-on-year and 10 percentage point increase quarter-on-quarter. This growth was primarily driven by the reassessment of insured asset values, higher insurance premium collections, and improved investment returns amid rising interest rates. Both Delta Insurance and Mohandes Insurance achieved strong growth, with net profit increasing by 72% and 27% year-on-year, respectively, in EGP terms during FY 2024. Looking ahead, management expects the insurance sector to maintain its positive trajectory, supported by continued upward revaluation of insured assets, stable premium growth, and a favorable macroeconomic environment. Additionally, NileWood is making significant progress toward the commercial launch of its MDF board production line, with operations set to commence in the first half of 2025. Egypt Kuwait Holding (EKH), established in 1997 with an issued and paid-in capital of USD 282 million, is listed on both Boursa Kuwait and the Egyptian Exchange. The company is one of the Middle East’s leading and fastest-growing investment entities, with a diversified investment portfolio spanning five key sectors: fertilizers and petrochemicals, gas distribution, power generation and distribution, insurance, and non-banking financial services.