26/01/2022

26/01/2022

Board proposes cash dividend of 30 fils per share … total assets grow by 11.9%

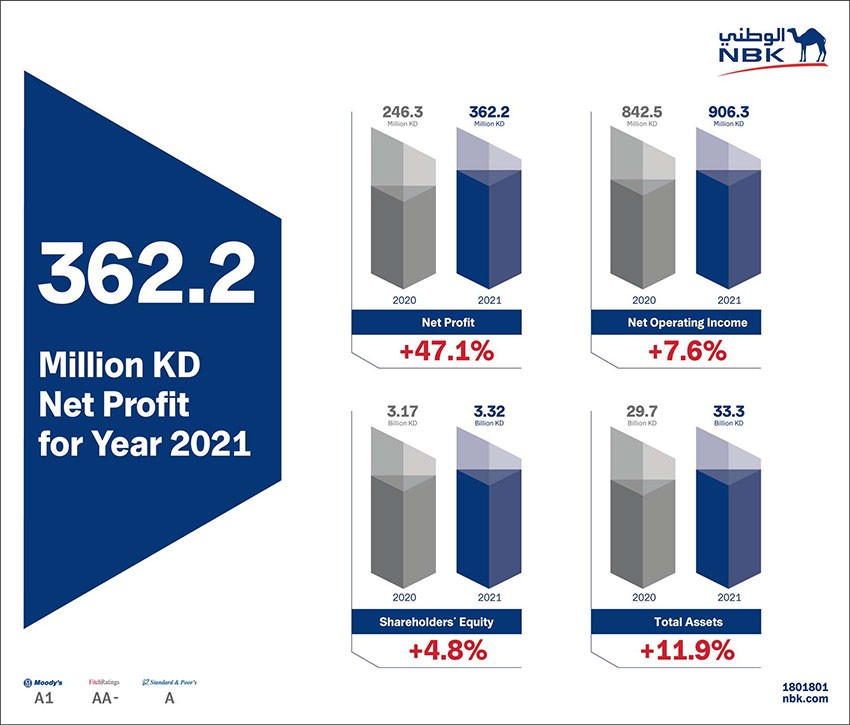

KUWAIT CITY, Jan 26: National Bank of Kuwait (“NBK”, the “Bank” or the “Group”) has announced its financial results for the twelve-month period ended 31 December 2021. NBK reported a net profit of KD 362.2 million (USD 1.2 billion), compared to KD 246.3 million (USD 814.4 million), improving by 47.1% year-on-year. As of end of December 2021, NBK’s total assets grew by 11.9% on annual basis, to reach KD 33.3 billion (USD 109.9 billion), while customers’ deposits grew by 6.9% to reach KD 18.3 billion (USD 60.4 billion).

Customer loans and advances on the other hand grew by 12.7% compared to the same period last year, to reach KD 19.7 billion (USD 65.2 billion)while total shareholders’ equity stood at KD 3.3 billion (USD 11.0 billion) by end of year 2021. NBK’s Board of Directors has proposed the distribution of a cash dividend of 30 fils per share, representing 59.6% of net profit, in addition to 5% bonus shares (5 shares for every 100 shares). The cash dividend and bonus shares, if approved by the shareholders’ general assembly, shall be payable to the shareholders after obtaining the necessary regulatory approvals. Earnings per share (EPS) stood at 47 fils, as compared to 31 fils in 2020.

Commenting on the results, NBK Group Chairman, Nasser Al-Sayer, said: “NBK delivered strong financial results despite the continued challenges posed by the pandemic on the operating environment and the global economy.” “NBK’s performance affirmed the fl exibility and diversity of the Bank’s business model in 2021 through achieving superior returns for its shareholders. The Bank demonstrated its unique ability to overcome the disruptive operating environment whilst persisting to invest in human resources and in our digital agenda to secure future growth,” he noted.

Al-Sayer added: “The bank enjoys a solid financial position alongside a strong and stable capital base; which supports our ability in meeting the growing needs of clients. Throughout the year, the Bank invested heavily in its strategic digital infrastructure in order to position NBK to grow and prosper over the long term.” “Despite the continued state of uncertainty stemming from the repercussions of the pandemic, the Bank maintained its commitment towards rewarding and adding value to shareholders through strong cash dividends and bonus shares distributions,” he elaborated ”The operational environment in Kuwait is promising in 2022 and we are optimistic with regards to the opportunities embedded; in light of the high vaccination rates which would eventually enhance business sentiment and contribute positively to economic growth alongside the support to the state’s fiscal standing from the recovery in oil prices,” he mentioned. “We take pride in the progress that we achieved in implementing the highest standards of corporate governance whilst embedding sustainability as an integral part of our corporate culture and operations. Furthermore, we will continue our promises in achieving responsible and sustainable growth and to sharing our successes with the communities in which we operate,” Al-Sayer stated.

Al-Sayer affirmed that: “NBK will continue in its responsible role in supporting the global objective of low-carbon emissions and mitigating the risks of climate change whilst delivering strides across other sustainability initiatives. In this regard, we have set specific goals for sustainable business, and are keen on embedding climate-related considerations as part of our business model in the future.” “We will continue to place considerable value on the health and safety of our employees and customers while ensuring the delivery of world class products and highest service quality. Moreover, the Bank will remain committed into supporting and contributing to the recovery of Kuwait’s economy,” he concluded.

On his part, NBK Group Chief Executive Officer, Issam J. Al Sager, commented: “Despite the resurgence of Covid-19 cases and the uncertainty around economic outlook during 2021, NBK succeeded in recording solid profits and exceeded strategic targets set for the year. The operating environment in Kuwait witnessed a moderate rebound that was characterized by higher consumer spending, improvement in business activity and volumes as well as gradual recovery in government spending and project awarding, which reached KD 1.5 billion in 2021.” “NBK delivered robust growth and strong financial performance across business lines. Regardless of the continued low interest rate environment, the Bank’s resilient loans and deposits growth contributed positively and supported in maintaining stable margins,” he added. “Thanks to the proactive and conservative approach that NBK adopted since the beginning of the pandemic, we now bear the fruits of recording lower cost of risk levels which contributed positively in growing our bottom line profits. Our operating income for the year increased by 7.6% to reach KD 906.3 million; driven by a robust growth in core banking income,” he mentioned.

Al-Sager noted: “The Group continued towards achieving its strategic objectives with wealth management and Islamic banking conveying decent growth and further endorsed its financing dominance and capabilities across retail and corporate segments. Moreover, our non-interest income continues to grow, taking advantage of the different markets where we operate and the strong relationships the Bank has established with its customers over many years.” “Our digital transformation continued to accelerate this year, driving efficiency and enhanced customer experience, while we also laid the foundation for future growth by launching Weyay, Kuwait’s first digital bank, to better attract and serve the needs of the youth,” he highlighted.

Al-Sager mentioned that “During 2021, NBK added a pool of prestigious awards in recognition of the quality of services and products delivered to clients. Likewise, the Bank asserted itself as a leading global financial institution issuer in the region as we succeeded in issuing two bonds to further enhance its capitalization & liquidity levels and to diversify the Group’s funding profile. The issuances marked a milestone for the Bank and further endorsed investors’ continuous confidence in the Bank’s prudent management and confidence in overcoming crises.” “In 2022, we will intensify our focus in constantly designing and delivering innovative propositions to our clients. We will also upgrade our digital infrastructure foundations to enrich customers’ experience and to serve as a springboard for regional growth and expansion; as well as investing heavily in our people – who represent the engine of our growth and success,” he promised. “NBK will remain agile in positioning and endorsing ESG as a core principle to the way we conduct and operate our business, with initiatives in relation to identifying and quantifying ESG already in place. Our commitment is ongoing, with special focus on assessing the direct and indirect environmental impact of our operations, especially as the risks of climate change continue to emerge.”

Performance and operating highlights FY 2021:

■ Total assets grew by 11.9% year on- year, to KD 33.3 billion (USD 109.9 billion)

■ Net operating income of KD 906.3 million (USD 3.0 billion), increasing by 7.6% compared to FY 2020

■ Customer deposits increased by 6.9% year-on-year to KD 18.3 billion (USD 60.4 billion)

■ Total loans and advances grew by 12.7% year-on-year to KD 19.7 billion (USD 65.2 billion)

■ Shareholders’ equity stood at KD 3.3 billion (USD 11.0 billion)

■ Strong asset quality metrics, with NPL/gross loans ratio at 1.04% and an NPL coverage ratio of 300%

■ Robust Capital Adequacy Ratio of 18.1%, comfortably in excess of regulatory requirements