06/08/2023

06/08/2023

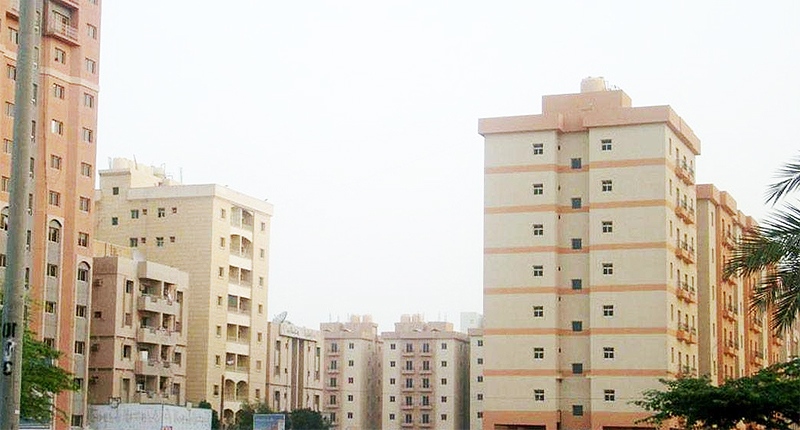

Salmiya tops number of vacant investment lands

KUWAIT CITY, Aug 6: According to a real estate report, as of the end of the second quarter in 2023, Kuwait had a total of 394,942 thousand housing units for investment purposes. Out of this number, 337,083 thousand units were rented, leaving approximately 57,859 thousand units vacant, as reported by sources cited in Al- Rai daily. The report, a collaborative effort between Aayan Real Estate Company and ESTATER Company, highlighted that while there is a growing demand for investment housing, the potential for increasing the supply is limited.

This limitation is due to the scarcity of available residential investment lands in Kuwait. The report revealed that there are only 2,205 lands, comprising a mere 14.7 percent of the total residential investment properties in the country. This percentage is notably low compared to neighboring regional markets, where the proportion often exceeds 40 percent.

As per the report by Aayan Real Estate Company in collaboration with ESTATER, it is projected that the average rental rate in the residential investment real estate sector will decrease to 4.42 dinars per square meter in 2023, marking an 8.5 percent decline from the rates in 2019. This decrease is expected to be due to an increase in occupancy and rental rates in the coming years, attributed to the growing demand in 2022 and 2023, with potential for continued growth in 2024. Looking ahead, the report anticipates that the average rental rate in the investment sector in 2025 will be approximately 4.55 dinars per square meter, the highest average since 2021. This rate encompasses all categories (first, medium, and low degree), across all regions and types of units, such as studios, one-room apartments, and two-bedroom apartments.

Intensified

Over the past 4-5 years, construction activities have intensified in various areas of Kuwait with a focus on investment housing, including Sabah Al-Salem, Mahboula, Mangaf, and others. However, no new residential investment areas or vacant lands have been added to the market. The Jaber Al-Ahmad and Sabah Al-Ahmad regions possess a limited number of lands suitable for building investment housing complexes, and only a few real estate developments have been established there.

This shortage of investment lands in Kuwait creates clear supply constraints that may have significant implications in the future. The report points out that many of these lands suitable for investment housing could instead be used for developing commercial real estate, such as clinics and offices. Consequently, the supply restrictions within the investment housing sector are expected to result in increased occupancy and prices as demand continues to rise.

Regarding vacant investment lands, Salmiya has the highest number with 393 vacant lands, followed by Sabah Al-Salem with 247, Fahaheel with 245, Jleeb Al-Shuyoukh with 230, and Mangaf with 203. In terms of occupancy rates, the report reveals that by the end of the second quarter of 2023, the real estate investment sector achieved an 85.4 percent occupancy rate, showing a slight improvement from the 85.1 percent recorded in 2022. The report predicts a gradual increase in occupancy rates over the following years, reaching 85.5 percent by the end of the current year, 86 percent in 2024, and 87 percent in 2025.