16/07/2024

16/07/2024

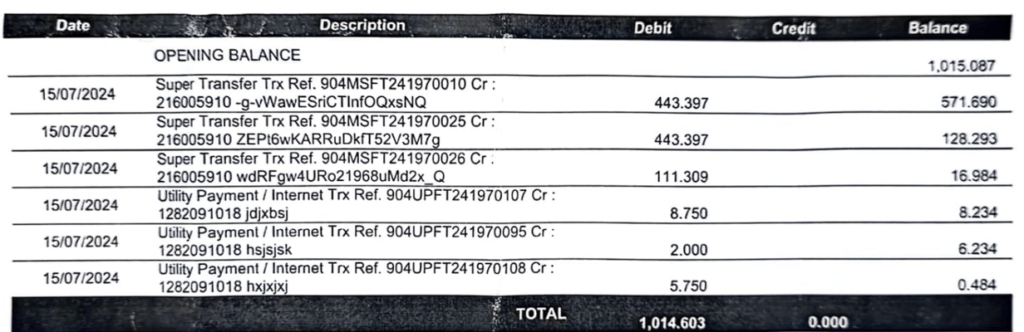

KUWAIT CITY, Jul 16: A Bangladeshi expatriate in Kuwait fell victim to a sophisticated phone scam, losing KD 1015 from his bank account. The scammer, posing as a representative from a local bank, called the victim and claimed that he needed to update his bank account details with the latest Civil ID information.

The scammer then requested the victim's bank account number, assuring him that he would receive a message from the bank asking for an OTP (One-Time Password). Trusting the caller, the victim provided the OTP, unaware that it would be used to drain his entire account balance within minutes.

Banks and the Ministry of Interior have warned the public to be cautious of such scams, which often involve criminals spoofing legitimate organizations to gain the trust of unsuspecting victims. They advise people to never share sensitive financial information over the phone, even if the caller claims to be from a trusted institution.

How Scammers Operate to Withdraw Money from Online Bank Accounts

Scammers often employ sophisticated tactics to gain access to victims' bank account information and drain their funds. Here's how they typically operate:

Phishing Scams: Scammers may send fraudulent emails, texts, or phone calls that appear to be from the victim's bank, asking them to verify their account details. Once the victim provides this sensitive information, the scammers can use it to log into the account and make unauthorized withdrawals.

Automated Withdrawal Schemes: Scammers may trick victims into providing their bank account and routing numbers, often under the guise of updating account information. With this data, they can set up automatic withdrawals to siphon funds from the account over time.

Impersonation Fraud: Criminals may pose as government officials, charity representatives, or other trusted entities to convince victims to share their banking credentials. Once they have this information, they can access the account and transfer money.

Password Cracking: Scammers use technology to rapidly guess weak passwords, allowing them to log into victims' online banking portals and steal funds. Using longer, more complex passwords can significantly slow down these attacks.

Skimming and Card Cloning: Criminals may install card skimmers on ATMs or point-of-sale terminals to capture account numbers and PINs, which they can then use to create counterfeit cards and withdraw cash.

To protect themselves, consumers should be wary of unsolicited requests for sensitive financial information, regularly monitor their bank statements, and use strong, unique passwords for all their accounts. Reporting any suspected fraud to the bank and authorities can also help limit the damage and prevent further losses.