09/06/2020

09/06/2020

Kuwait, June 9: Boursa Kuwait Securities Company (BKSC) held its E-Annual General Assembly (AGM) meeting for the year ended 31 December 2019 today, Tuesday, June 9, 2020. During the meeting, which was held virtually as part of the company’s commitment to ensuring the safety of its shareholders and in line with the preventive measures introduced by the Kuwaiti government to curb the spread of COVID-19, the Board of Directors’ (BoD) recommendation to distribute 25% of the paid-up capital, equivalent to 25 fils per share, as cash dividends was approved, with a total value of about KWD5.02 million (Five million, nineteen thousand, three hundred and ninety three Kuwaiti dinars and seven hundred and fifty fils).

The Board of Directors' report, the Auditor's report and the audited financial statements for the fiscal year ending on December 31, 2019 were all approved, as were the Corporate Governance and Audit Committee reports and the remunerations and benefits report for BOD members and Executive Management.

The AGM was chaired by Vice Chairman, Mr. Ahmed Hamad Al-Thunayan, who read the reports issued by the Kuwait Clearing Company’s electronic system regarding the quorum of attendance, the results of participation and voting included in the agenda, as well as a report of the shareholders' notes.

Shareholders agreed to grant the Board of Directors authorizarion to buy or sell the company's shares, provided they do not exceed 10%, in accordance with the provisions of Law No. 7 of 2010 and its executive regulations and amendments. Shareholders also discussed and approved the Related Parties’ Transaction Report for 2019 and the related parties’ transactions, which are proposed to be conducted during the upcoming 2020 financial year. Finally, the appointment of Mr. Badr Adel Salem Al-AbdulJader from Ernst & Young (Al-Aiban, Al-Osaimi & Partners) as the auditor for the fiscal year ending on December 31, 2020 was also approved.

Al-Thunayan said: "Boursa Kuwait recorded several achievements that contributed to its path of development and progress during 2019. Among the most prominent of these accomplishments was the completion of the stages of privatization of the company to become the first privatization project for a vital government facility, and thus becoming the first stock exchange owned by the private sector in the Middle East, with private investors owning 94% of the issued and paid-up capital of the company, thanks in no small part to its cooperation with the Capital Markets Authority.”

Al-Thunayyan also highlighted the exceptional and unprecedented performance achieved by Boursa Kuwait and hailed the commitment of the Board of Directors to support the company’s strategy, given its many achievements despite the challenges facing the market last year.

Al-Thunayan added: "Boursa Kuwait’s strategy aims to develop a strong financial market that enjoys high liquidity and credibility through the implementation of a host of developmental, structural and technical projects. The company has made great progress in its path to be a leading and prominent stock exchange in the Middle East, and a market ranked by the most prominent global indicators."

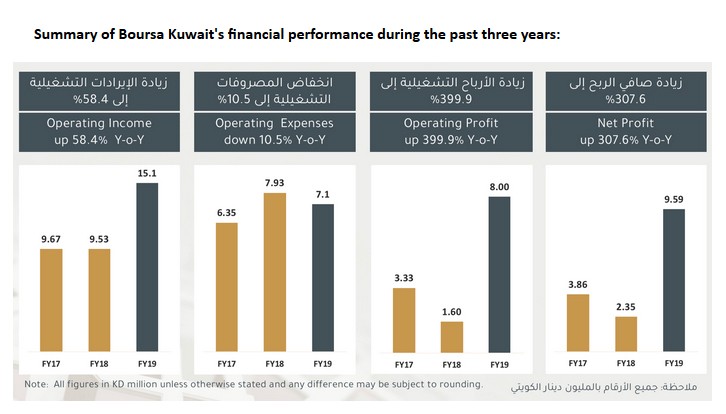

"Boursa Kuwait has fulfilled the promise it made to itself to continue to grow at an upward pace and to upgrade the country’s financial market system. As a result, the company recorded a significant jump in operating profits, while net profit increased by more than 307%.”